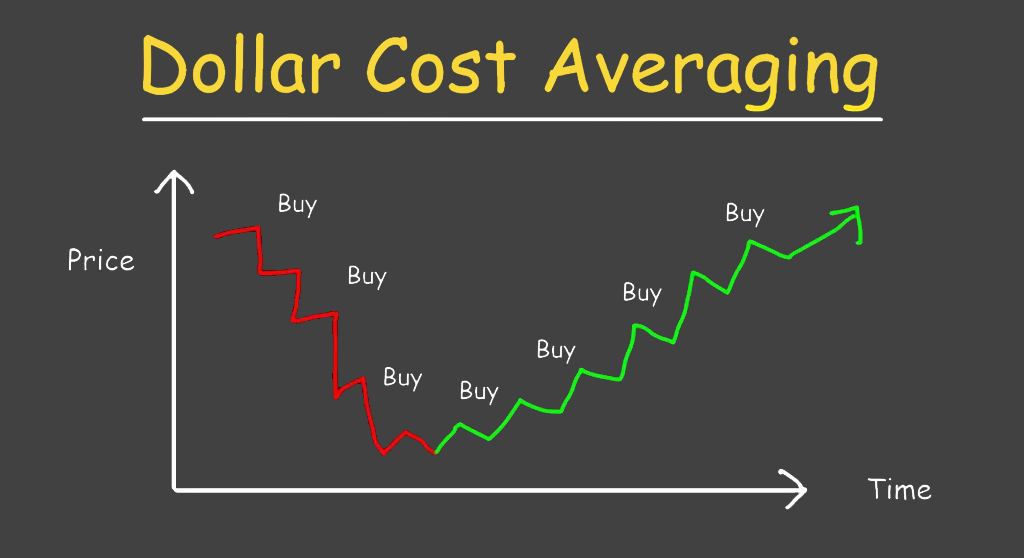

Dollar Cost Averaging (DCA) is an investment strategy that involves investing a fixed amount of money at regular intervals into a particular asset, regardless of its price. This strategy is often used by investors to reduce the impact of volatility on their investments and to smooth out the ups and downs of the market. It is therefore the perfect investment strategy for higher risk stocks. Since Loomo is 100% focused on higher risk, high return, DCA strategy has been built-into the app.

In the Loomo app, you are shown a curated list of high growth opportunities (companies to invest in). Once you select an opportunity, Loomo then asks how much you want to invest monthly. This monthly investment is handled by Loomo. It will consistently purchase shares of the company on your behalf over the 1 month investment period.

One of the key advantages of dollar cost averaging is that it allows you to take advantage of the changes in the market and purchase more units of an asset when prices are low and fewer units when prices are high. This means that the average cost per unit of the asset will be lower than if you had invested a lump sum at one time.

Another advantage of dollar cost averaging is that it can help you overcome your fear of investing. You may be hesitant to invest a large sum of money all at once, especially when the market is volatile. By investing small amounts at regular intervals, investors can reduce your risk and feel more comfortable with your investments.